Interest Only Loan Calculator: How It Works | Red Sun IT Services

2025-10-22 • RedSun IT Services

Interest Only Loan Calculator: Estimate Your US Mortgage Payments

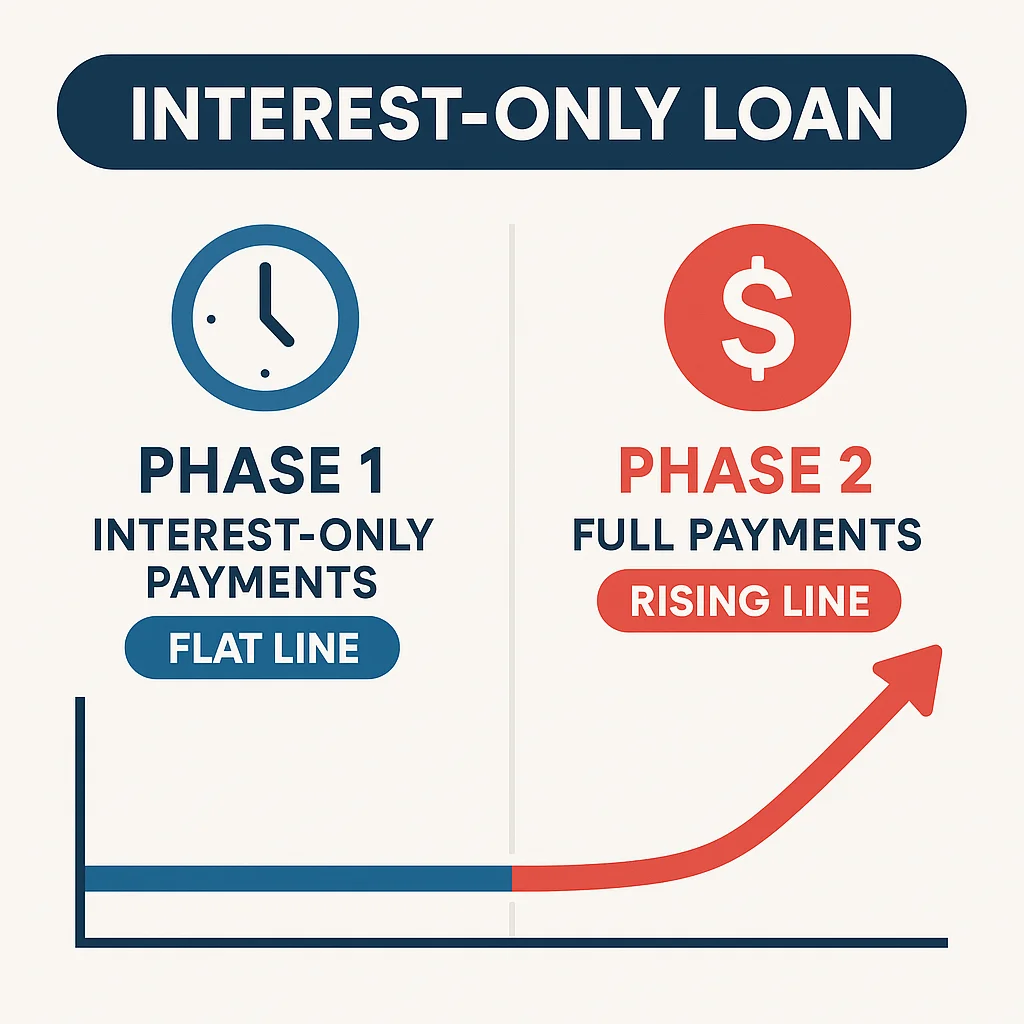

An interest only loan calculator is an online tool that allows homebuyers to see how the monthly payments will work if they select an interest-only mortgage. Unlike a traditional mortgage, which pays down both interest and principal with every payment, an interest-only loan has a time frame to make interest payments only when the loan balance doesn’t decrease. This is usually for a period of 5–10 years. During this time frame, you are not building any equity in your home. With interest-only loans, you are not paying down the principal balance of the loan, just the interest. The calculator asks for information such as the loan amount (or principal), the interest rate, and how long you are able to pay interest only, then it will provide you with a monthly interest payment and how the payment will change once you begin paying principal. It could help get you thinking about budgeting and help you with comparison shopping for loans, and make sure you are ready for higher payments once you pay on the principal.

- Definition: An interest-only mortgage lets you pay only interest for an initial term. For example, CFPB explains that these loans have scheduled payments where you pay only interest for a specified time.

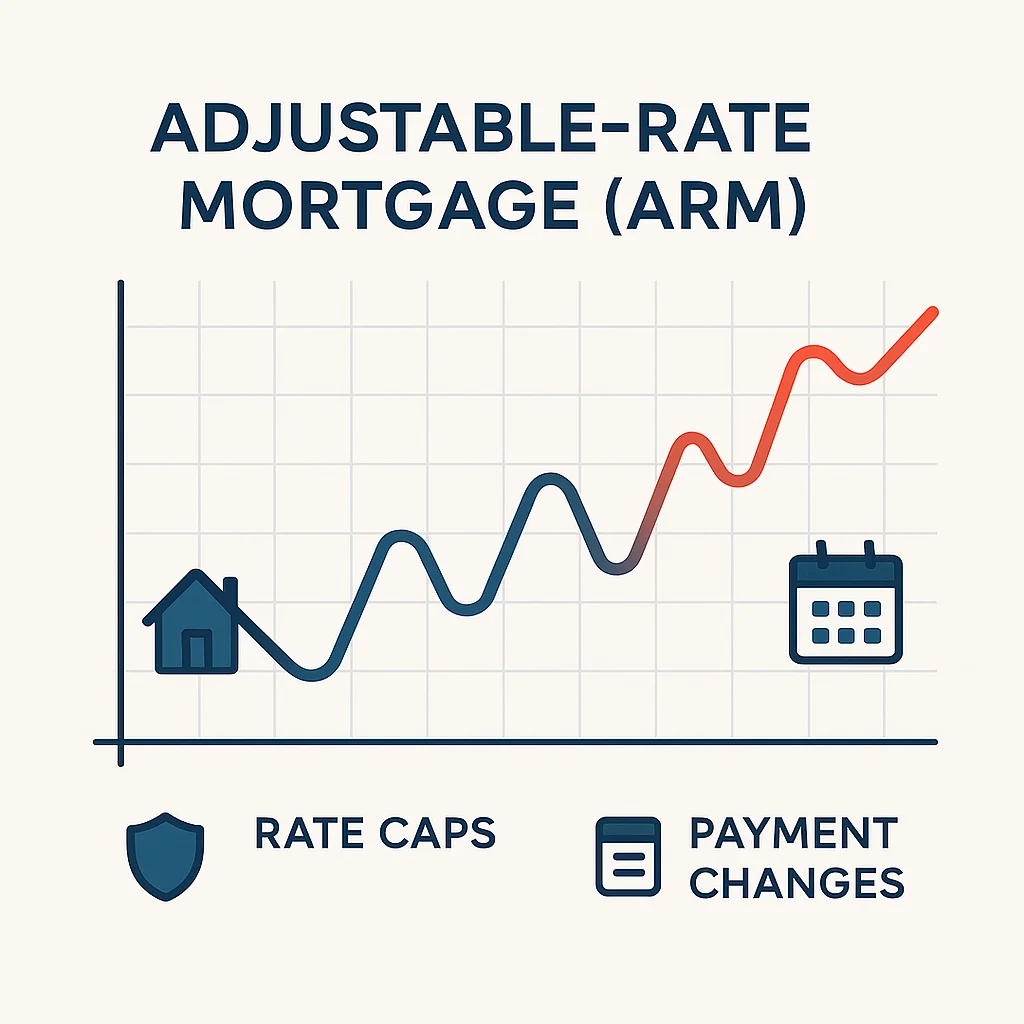

- How it works: Typically offered as an adjustable-rate mortgage (ARM), an interest-only loan will convert to a standard amortizing loan after the interest-only phase. At that point, you must begin paying both principal and interest, which significantly increases your monthly payment.

- Loan balance: Since you’re not paying down principal during the interest-only period, the outstanding balance remains unchanged. When the period ends, you either refinance, pay off the loan in full, or start paying off the balance with higher monthly installments.

Using an interest only loan calculator allows borrowers to gauge what these products will mean for payments. For instance, if you were to borrow $250,000 at 3.75% interest on a 30-year loan, with a 5-year interest-only period, you would see a calculator estimated payment of approximately $781.25 per month during that initial five year period. Once the interest-only period was completed, the same loan would then require a payment of about $1,285.33 per month for the remaining 25 years. A good loan calculator, either created by a bank, or a financial website like Bankrate, or typically, along with a range of features will allow side-by-side comparisons between an interest-only loan and a fully amortized loan.

How Interest Only Loans Work

Interest only mortgages or loans are designed with two primary phases. The initial phase is the interest-only phase, which typically lasts 5–10 years, during which the borrower pays interest only. Following that, the loan will “convert” to a conventional payment plan and the payment will consist of a combination of principal and interest. The way that conversion occurs varies amongst loans. Many loans simply require that the remaining balance be divided over the term of the loan, significantly increasing the monthly payment. In some cases, the borrower will be required to make a balloon payment at the end of the interest-only phase, which will require a lump-sum payoff or refinance.

- Adjustable Rate Structure: The majority of interest-only mortgages are ARMs or adjustable rate mortgages. For instance, a 7/1 ARM is representative of 7 years of interest-only payments, followed by interest resets each year for the next 23 years. At the beginning of the fixed period, your rate, and thus payment, will stay the same. But, once the fixed period ends, your interest rate (and payment) will float with the market. While there are usually caps in place to limit increases to the payments each year, any interest that was unpaid will be added to the loan balance.

- Non-QM Loans: As a result of their risky characteristics, most interest-only loans are non-qualified mortgages (non-QM). LendingTree notes that loans like this can have risks (the interest-only term and possibly a balloon payment), so they generally don’t qualify for FHA, VA, or USDA programs. In real-world terms, this usually means that you’ll want to have a strong credit profile and a sizable down payment in order to qualify. Lenders often prefer a credit score above 700 (sometimes higher), a DTI (debt-to-income) ratio of under about 36%, and a down payment of 15%+. Strict guidelines help ensure borrowers can handle the tougher terms in the future.

- Repayment Options: At the conclusion of the interest-only phase, Generally, there are three options: (a) refinance out into a new loan, (b) pay off or sell for the outstanding balance, and (c) simply start paying both principal and interest on the existing loan. You may have a calculator that allows you to analyze each scenario. You can refinance before increased payments begin and reset your schedule assuming market conditions support a refinance. You can time the sale to the greatest value of the home.

Investopedia asserts that the main trade-off is cash-flow flexibility now for later costs via higher payments. Smaller payments in the early years will mean that you'll have more money for monthly expenses, but this is at the cost of not building up any equity whatsoever. Planning ahead is important here; you should know you can handle that increase in payments later, or have a plan (for example, to sell) before the interest-only period is over.

What are the Benefits and Risks

Interest only loans have specific advantages and disadvantages. It’s important to weigh them carefully before using an interest only loan calculator or choosing this loan.

- Lower Initial Payments: There is a strong advantage that will be obvious: your monthly payment is significantly lower in the beginning because it is only interest. For instance, a loan that normally amortizes might have a $2,040 payment, compared to the interest-only payment of just $1,805 in the early years. This might also open the door to getting into a house sooner if you are short on cash.

- Increased Cash Flow: With the lower monthly payments, you will have some extra cash each month. Business Insider states that borrowers may use the cash flow for investment, home improvements or other goals while in the interest-only period. Think of it as a temporary way to try and stretch your budget or invest the savings elsewhere where you might earn a better return.

- Flexibility in Payments: Some interest-only loans even allow you to pay more principal when and if you want during the interest-only period. In short, you could put a principal higher payment or lump-sum principal whenever you wish, in the event the only payment due is interest. As stated by lenders such as Carlyle Financial, this is especially advantageous if your income were to unexpectedly spike, or you want to build equity sooner rather than later.

However, interest-only mortgages carry notable risks:

-

No Equity Growth: Because there is no principal paid down, you do not accumulate equity unless the home appreciates in value. Your early payments are simply covering interest. The CFPB points out that at the end of the interest-only period, your choices include paying off the full amount in a lump sum or new principal payments that will significantly increase your payment. Essentially, for the first few years, you will own the same amount of debt if the home does not appreciate in value.

-

Higher Long-Term Costs: Over the life of the loan, you will typically pay much more in interest than a standard loan. In a LendingTree example, a $300k, 10-year interest only mortgage at 7.22% resulted in roughly $49,800 more paid in interest over 30 years than a 30-year conventional fixed loan. (The initial monthly payment for the interest only loan was $1,805 versus $2,040 for the amortizing loan, but total interest on the loan increased from ~ $434,554 to ~$484,362.) This illustrates that obviously, the only savings is front-loaded in the initial payment.

-

Payment Shock: Upon the ending of the interest only phase, your monthly payment can significantly jump up, as you will pay principal in addition to interest. For example, a home costing $250,000 at 3.75% was an interest only payment of $781.25 for five years, and then the full amortization payment jumped to $1,285.33. If you have not accounted for this jump, it could put a strain on your budget. Consumer Finance suggests that planning on an event occurring (like refinancing or the home appreciating) is no way to manage your future payments.

-

Market and Default Risk: If home values fall, or your income falls before the end of the interest only term, you could owe more than the home is worth, or you simply may not be able to afford the larger payments. Both Investopedia and Business Insider note that interest-only loans carry a higher risk of default, unless homeowners are prepared for future payments. Only borrowers with a very sound financial position and backup options (savings or sale) should consider an interest-only loan.

NerdWallet classifies interest only mortgages as “niche products” for borrowers who have strong cash flow and only intend to hold the property for a short period (typically 5–7 years). They emphasize that these loans are usually classified as jumbo loans because they cannot fit within the conventional limits. In real-life terms, this means that interest-only loans are beneficial for investors who flip a home, buyers who expect their income to increase soon, or borrowers who want flexibility in the first few years.

How to Use an Interest Only Loan Calculator

A key part of evaluating an interest only mortgage is running the numbers through an Interest Only Loan Calculator. These calculators simplify the math so you don’t have to do it by hand. Typically, you’ll input:

- Loan Amount (Principal): The total amount you’re borrowing for your home purchase. (For example, if the home costs $300,000 and you make a $30,000 down payment, enter $270,000.).

- Interest Rate (%): The annual interest rate on the loan. If it’s an ARM, you might enter the introductory rate (and later consider rate changes). You can adjust this number in the calculator to see how rate changes affect payments.

- Interest-Only Period: Specify how long the loan is interest-only (e.g. 5 or 10 years). Our interest only mortgage calculator will then compute your monthly payment during that time and show how your payment will change afterward.

- Loan Term: Often 30 years total. After the interest-only phase, the remaining term (e.g. 25 years if IO is 5) is used to amortize the loan fully. The calculator uses this to project your future payments.

Upon entering the information, the tool will immediately present you with: (a) the monthly interest-only payment during the introductory period, and (b) the new monthly payment when the borrower begins repaying the principal. It may also show you an amortization schedule or other charts. Based on Carlyle Financial’s definition, a good calculator “shows you what your interest-only monthly payments will be based on the loan amount, interest rate, and interest-only period you have selected”.

Using an interest only calculator has significant benefits. According to HomeLight, “these tools provide borrowers with the ability to learn how to calculate payment on interest-only loans, better informed decisions… and fits into their budget, both now and in the future.” Once you are familiar with using the calculator, you will be able to justify changes to your inputs to test scenarios. For example, you may want to enter a shorter vs. longer interest-only period, or change rates, and see how that changes your payments and overall interest cost at the same time. Having this type of understanding is very important because interest-only loans can come to very complicated outcomes.

Use of this interest only loan calculator ensures you plan effectively. You’ll get a clear picture of:

- Monthly Budget: Exactly how much you pay each month now versus later.

- Total Interest Cost: The tool can show you total interest paid during the IO phase and over the full loan life, highlighting the long-term cost.

- Payoff Schedule: Many calculators (including ours) let you add extra payments to see how paying more principal early affects the timeline and interest.

- Comparison: Crucially, you can compare the interest only scenario to a standard amortizing loan. The calculator lets you toggle between loan types or run two scenarios side by side, illustrating the trade-offs clearly.

Interest-Only Loans vs. Standard Mortgages (Comparison)

To highlight the difference, consider an example scenario: a $300,000 home loan with an interest rate of 7.22%. For a 30-year conventional (fully amortized) mortgage, your approximate monthly payment would be around $2,040, and your total interest paid over the life of the loan would be about $434,555. If you chose a 30-year loan with the first 10 years being interest-only, your payment during those first 10 years would decrease to about $1,805. But once your principal payments begin in the 11th year, your total monthly mortgage payment jumps to $2,366, and total interest paid would amount to around $484,362. In other words, with the interest-only loan, you saved about $235 per month in payment for those 10 years, but paid approximately $49,800 more in interest over the loan. This example (LendingTree) illustrates several key differences:

- Initial Payment: Interest-only ≈ $1,805 vs. Conventional ≈ $2,040. The IO loan’s initial payment is about 11.5% lower.

- Payment After IO: After 10 years, the IO loan’s payment increases above the conventional payment ($2,366 vs. $2,040). This illustrates “payment shock.”

- Total Interest: IO loan accrues ~11.4% more total interest ($484k vs. $434k).

- Equity Build-Up: The conventional loan builds equity from day one, whereas the IO loan builds none until year 11.

- Risk Profile: The IO borrower assumes market and refinancing risk; the conventional borrower has a fixed principal payment schedule.

For both loan options in this example, the interest rate is the same, 5.9% (7.22%). It’s worth noting that with the IO loan, you will always have the option to make larger payments during the interest-only years (pay some principal) to reduce payments later. If you are paying only the minimum, however, it will accrue more interest. You can see the difference in outcomes by using an interest only loan calculator and a standard mortgage in tandem. You can enter the same loans twice, once as Interest-Only, and once as Fixed-Rate.

For many borrowers, it comes down to their goals. For example, if you’re anticipating you will own the home only for a short while (situation may be investor or someone who expects a substantial change in income), the lower initial payments available on interest-only loans could benefit you moving in sooner. NerdWallet says interest-only loans are generally better suited for a 5 and 7 year horizon. On the other hand, if you think you will own the home long term or want to build equity immediately, a traditional amortizing loan generally provides that more secure option. Consider a loan calculator (or amortization) to help weigh those decisions.

Our Red Sun Mortgage Calculator includes a dedicated interest-only option. Under the “Loan Type” field, you can select Interest-only (alongside Fixed-rate and ARM). Enter your home price, down payment, interest rate, and choose the interest-only period. The calculator will then display your estimated monthly payment during the interest-only phase and the payment after that period ends. It even provides a full amortization schedule so you can export or review year-by-year balances and interest. Try it to compare scenarios instantly. For example, set up a $300,000 loan at today’s rates with a 10-year IO period, and see how both your initial low payments and later payments come out

Why Use Our Red Sun Mortgage Calculator?

Whether you’re considering an interest-only mortgage or a traditional loan, the Red Sun Mortgage Calculator is a powerful tool to make informed decisions. It’s designed specifically for US borrowers and incorporates best practices:

- Ease of Use: The interface is intuitive; with a separate option for interest only, just select the loan type and add all the necessary information and boom your results in seconds. No complex formulas needed.

- Customizable: Adjust the loan amount, interest rate, term, and interest-only duration to see instant updates. You can also add property taxes, insurance, or extra payments to reflect your real situation.

- Visualization: It generates charts and schedules. You can visualize the balance over time, compare interest vs. principal paid each year, or export a full amortization table.

- Comparisons: Easily compare different strategies. For example, try our tool with interest-only enabled, then switch to a fixed-rate mortgage to see side-by-side how payments and totals differ.

- Educational Guides: The calculator page also includes clear explanations (like what principal and interest mean, why each input matters). This helps demystify the process even if you’re new to mortgages.

We encourage you to use our loan or mortgage calculator as part of your homebuying research. It’s free and can be accessed anytime on the Red Sun website. By running the numbers before you lock in a loan, you’ll know exactly what to expect and avoid surprises later.

To conclude, if you are considering non-traditional loans, an interest-only mortgage calculator is a valuable planning tool. You can start to project your initial low payments, higher payments down the road, total interest, and break-even points. After providing that diagnostic information, you will ultimately need to make a decision about whether an interest-only mortgage is part of your strategy having looked into reputable sources like Consumer Finance (CFPB) and professional mortgage sites. Consider the long-term costs as well: with interest-only loans, as LendingTree points out, you may end up paying tens of thousands of dollars more in interest alone. However, if you are uncertain about your decision, reach out to a financial advisor to consult with. Until then, please feel free to see how our calculator works by testing it out with an interest-only mortgage comparison to a traditional mortgage and see how that fits with your intended budget and overall goals.